Imagine a world where every transaction feeds an autonomous machine, accessible to all. Where transaction fees do not disappear into the pockets of intermediaries, but are transformed into profits for those who dare to participate.

Welcome to the world of Hyperliquid

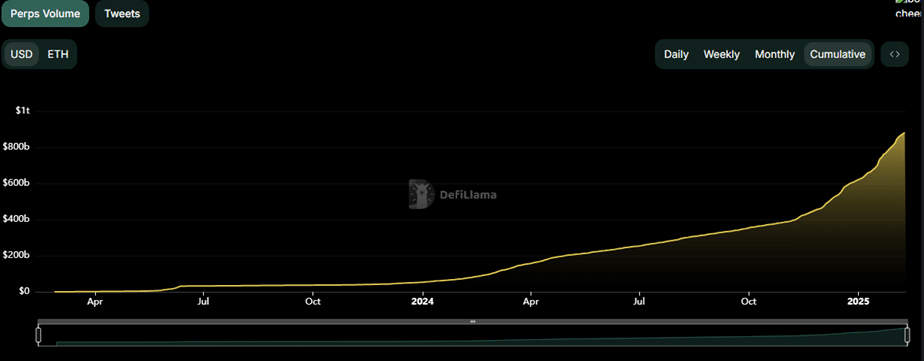

It all started in 2023, when a team of former institutional marketMarket A place where assets are bought and sold. makers diagnosed the industry: DEXs had failed to replicate the efficiency of CEXs. Their sin? Having neglected the technical constraints of on-chain order books, these infrastructures that transform liquidityLiquidity The ease with which an asset can be bought or sold without affecting its price. mechanisms into insurmountable challenges. Founded by a team of engineers from Google, Citadel and Hudson River Trading, the protocol already has more than 200,000 users and has processed more than $800 billion in volume since its launch.

Join Hyperliquid

A more than successful launch

When a protocol issues a tokenToken A digital asset issued on a blockchain, representing various utilities, rights, or value., the launch is perhaps the most important step, whether in terms of marketing or transparency. A failed launch is often the death of a project. The team behind HL understood this very well.

That is why on November 29, 2024, what was going to be the biggest airdropAirdrop The free distribution of cryptocurrencies to existing holders or community members to promote a project. It's an excellent way to distribute tokens among different users and launch a project. that crypto has ever known was announced. Some 310 million $HYPE tokens were distributed, at a nominal value of $2 per token at launch. You already know the rest of the story: An unstoppable run up to $35, before stabilizing in the $20-25 rangeRange The difference between the highest and lowest prices of an asset within a specific period..

The best part of all this? No funding from dubious VC funds, who could be likely to dumpDump The massive sale of an asset, causing a price drop. their tokens acquired at a much lower valuation. In short, a smashing launch and successful marketing for the platform that now wants to compete with the biggest CEXs.

The heart of Hyperliquid

Three innovations form the basis of the protocol:

A native blockchainBlockchain A public and immutable ledger of cryptographic transactions, organized in blocks. (L1)

Hyperliquid is a specialized LayerLayer Refers to different levels of protocols or platforms in the blockchain ecosystem, such as Layer 1 (base blockchains like Ethereum) or Layer 2 (scaling solutions built on top of Layer 1). 1 designed for perp trading, combining the speed of a CEXCEX A centralized exchange platform controlled by a single entity. (0.2 seconds latency, 100,000 TPS) and the transparency of DeFiDeFi DeFi services use smart contracts, decentralized protocols, and tokens to offer a range of financial services that can sometimes replace those offered by banks, such as lending/borrowing, asset management, insurance, or asset exchange. thanks to a fully on-chain orderbook. Its architecture is based on HyperBFT, a consensusConsensus An agreement among blockchain participants on the validity of transactions. It is a key concept, essential for ensuring that all nodes on a chain share the same information. derived from Hotstuff/LibraBFT, allowing automated liquidations via a hybrid oracleOracle A service that provides off-chain data to a blockchain, enabling smart contracts to interact with real-world information. (CEX price + internal data). Everything is processed on-chain, which reduces the risks of manipulation and increases transparency.

The Hyperliquid Vault (HLP)

The Hyperliquid Pool (HLP) is much more than an LP (liquidity pool). It is a vault set up by Hyperliquid directly, which allows everyone to benefit from the platform’s trading fees. In short, it is the opportunity for any user to benefit from market making on the platform. The vault benefits from the revenues generated by HL’s native AMMAMM An algorithm used in decentralized trading platforms (DEX) to provide liquidity using pools. Liquidity providers deposit into these pools and receive a share of the fees generated by transactions. The algorithm determines the asset price based on supply and demand in the pool.. Result: an average APY of up to 20% (usually between 10 and 15%), recalculated every hour (variable rate), and which varies according to the fees spent by traders on the platform. This is also the reason why the vault and more particularly the $HYPE token are so resilient during periods of sharp decline for example. Forced liquidations bring in more than a simple position closing. It is also possible to follow the activity of the HLP at the following addressAddress A unique string of characters that identifies an entity or account on a blockchain network, allowing the sending and receiving of cryptocurrencies.: 0x0d01dc56dcaaca66ad901c959b4011ec

The assistance fund

The assistance fund is designed to supportSupport A price level where buying pressure is expected to be strong enough to prevent further price declines. the value of $HYPE and support the Hyperliquid ecosystem. It is fueled by a portion of the platform’s revenues (trading fees, HIP-1 auctions). Currently focused on perps, these additional flows will be fully injected into the AF. A buyback machine that creates structural upward pressure for the integrated tokens. Hyperliquid has already started to diversify the basket of assets held by the AF, adding PURR, up to 3M, which represents approximately 0.5% of the total supply at the time of inclusion.

Join Hyperliquid

Next generation standards

HIP-1: The Native Assets Codex

HIP-1 is a native protocol of the Hyperliquid blockchain that allows the creation of tokens directly linked to an on-chain spotSpot A market where assets are bought and sold for immediate delivery. order bookOrder Book A book displaying buy (bids) and sell (asks) orders on a market.. Unlike standards like ERC-20, each HIP-1 token has an order book integrated into the blockchain from the moment it is deployed, eliminating the need for third-party DEXs or external LPs.

Creators define a maximum supply (unchangeable) and divisibility parameters (weiDecimals for minimum units, szDecimals for tradable lots), which guarantee full transparency from the genesis. The issuance of HIP-1 tokens is controlled by a 31-hour Dutch auction, where the price starts at double the last assigned tickerTicker A short symbol used to represent a cryptocurrency on a trading platform. (e.g. 975,000 USDC for GOD) and decreases linearly to 10,000 USDC. We discuss the auction part in detail later in the article.

This mechanism therefore limits to ~280 new tokens per year, which avoids sometimes abusive deployments. Unlike classic AMMs, HIP-1 eliminates the risks of impermanent loss (IL) and loss-versus-rebalancing (LVR), while offering permanent liquidity without depending on external market makers. We could notably take the example of PURR, the first HIP-1 token launched by the Hyperliquid team, which reached a capitalization of $15M upon its launch, without abusive listing fees or opaque agreements with market makers.

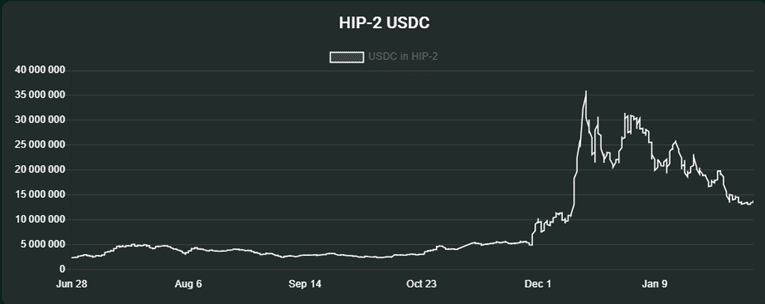

HIP-2: the Hyperliquidity engine

This protocol could, for the most optimistic, rival the algorithms on CEX.

HIP-2 allows for 0.3% slippageSlippage The difference between the expected price of a trade and the actual price at which it is executed, often occurring during periods of high volatility or low liquidity. on $100,000 orders versus 1.2% on Uniswap. But the real magic lies in how HL handles price discovery. In fact, HIP-2 aims to democratize liquidity for HIP-1 tokens in the “price discovery” phase, combining an AMM-inspired strategy (like Uniswap) with Hyperliquid’s native order book.

Unlike static LPs, liquidity automatically adjusts every 3 seconds to maintain a 0.3% spreadSpread The difference between the highest bid price and the lowest ask price on a market., without manual intervention. Key parameters (initial price, order size, “pre-seeded” liquidity levels) allow creators to bootstrap a balanced market.

Integrated directly into the L1 consensus, the mechanics guarantee transparency that is impossible to find on a CEX, and resilience that is difficult to achieve on a DEXDEX A decentralized exchange platform without a central authority, often using AMMs to enable trades..

The Vaults

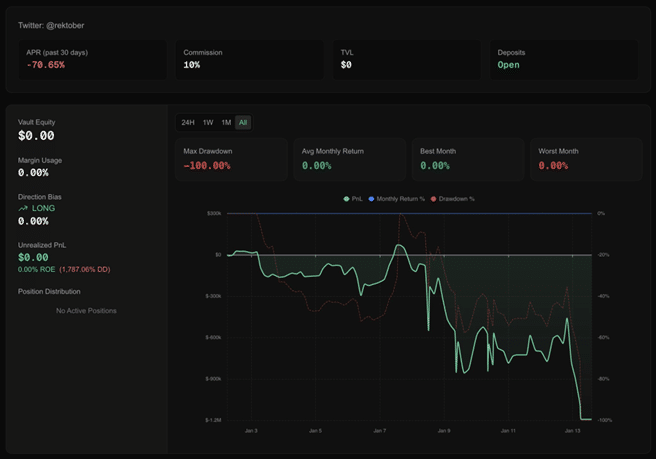

We have previously mentioned the aspect of HLP as a redistributor of profits related to market making. But vaults can also be used for purely speculative purposes. Indeed, it is possible for any HL user to use the principle of vaults to establish a strategy, and make depositors on the vault benefit from it. This means that users can benefit from the skills of the best traders (and the worst, we have for example the failed example of the Rektober vault, see the article ‘How to spot grifters‘)

For example, by depositing in a vault dedicated to a particular trading strategy, users can benefit from the returns generated by that strategy without having to manage it themselves. The managers of these vaults receive performance fees, thus aligning their interests with those of those who deposit.

Transparent liquidations

Liquidations on Hyperliquid are triggered when an account value falls below the maintenance threshold, which is half of the initial margin for maximum leverage ranging from 3x to 50x. This means that the maintenance margin ranges from 1% (for 50x leverage) to 16.7% (for 3x leverage), depending on the assetAsset Any digital asset, including cryptocurrencies. in question.

When an account reaches this critical threshold, positions are first attempted to be closed by market orders sent to the orderbook. If these orders are successfully executed, either in full or in part, so as to satisfy the margin requirements, all remaining collateralCollateral Assets deposited as security to borrow other assets. Used to ensure that the borrower repays on time and avoids default. If the value of the collateral drops, the creditor may request additional collateral and sometimes issue a margin call. will be retained by the trader.

If the account value falls below two-thirds of the maintenance margin without order book liquidations being possible, a safeguard liquidationLiquidation The forced sale of an asset when the margin requirements are not met in a leveraged trading position. is triggered via the liquidator vault, a component of the HLP. This vault takes over positions that cannot be liquidated by the order book, transferring the positions and margins to the liquidator.

Unlike other platforms where the profits from liquidations go to the exchange operator or to privileged market makers, on Hyperliquid, these profits are redistributed to the community via the HLP. In short, no more myth of market makers chasing your stop-losses!

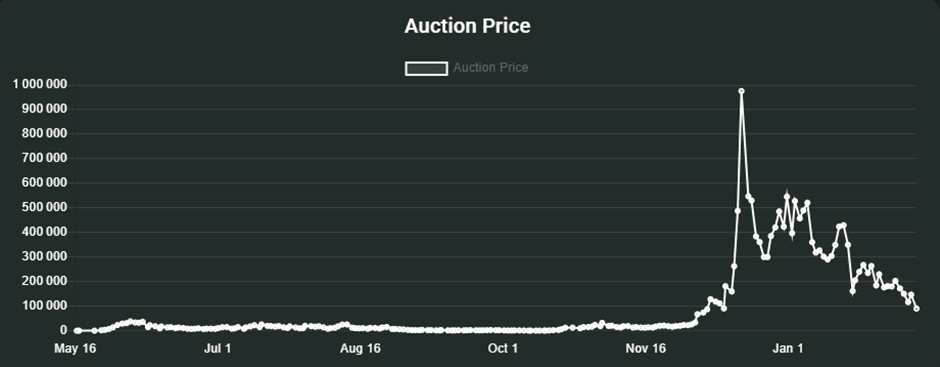

When Dutch auctions reinvent the listing market

In today’s ecosystem, where listings on CEXs are often opaque and costly negotiations, Hyperliquid introduces a game-changing mechanic: the on-chain Dutch auction. This system determines the price of listing rights through a top-down and transparent process.

Every 31 hours, a new auction starts automatically. The initial price is set at double the final amount of the previous auction. If the $MON token sold for $487,936 in December 2024, the next one starts at $975,873, then gradually decreases until a buyer accepts the price. This cycle creates a virtuous artificial scarcity: only 282 tokens can be listed annually, guaranteeing quality and exclusivity.

Unlike CEXs where listings are bought through private deals (sometimes for millions of dollars), Hyperliquid turns this stage into a public event. Projects must now prove their value on an open market, without privileges for insiders.

BTC spot now available

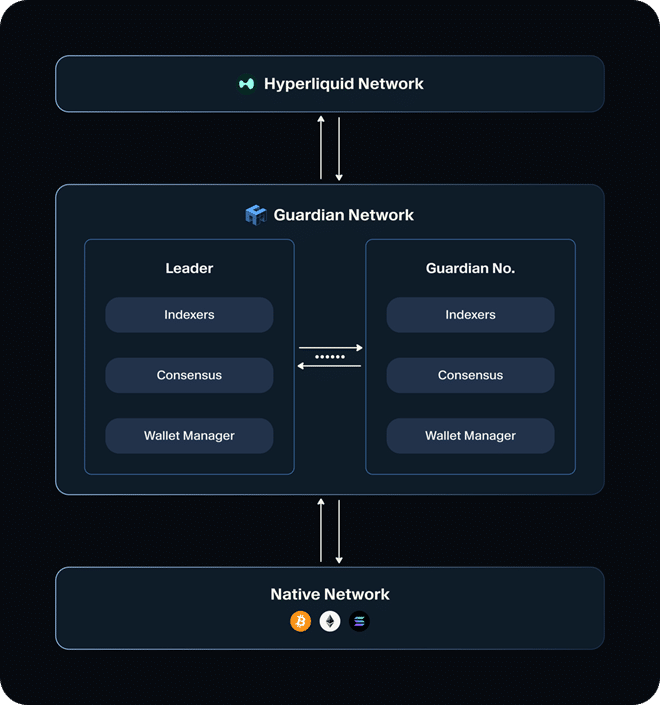

The recent integration of Bitcoin spot trading on Hyperliquid shows again the strength of the protocol, thanks to Unit’s cross-chain infrastructure. This system allows direct deposits/withdrawals of BTC to spot balances. Unit relies on a network of 16 “Guardians” operating a MPC (multi-party computation) protocol to generate signatures.

Each Guardian maintains:

BTC deposits trigger a sequence verified by at least 3 Guardians:

- On-chain finality verification

- BTC credit in Hyperliquid spot balance

- Transparent HIP-1 order book update

Unlike traditional bridges, Unit therefore eliminates wrapped tokens – the traded BTC is actually custodied by the Guardians network via 2-of-3 multisig addresses.

This update once again positions Hyperliquid as the most advantageous DEX at the moment, and therefore makes it possible to offer native BTC spot with institutional liquidity (100,000 TPS) to its users.

The paradox of deliberate centralization

Despite all the qualities and ingenuity of Hyperliquid, the protocol maintains a relative centralization, with only 16 validators (although there were only 4 a few months ago). Eventually, the transition to the mainnetMainnet The main blockchain network where real transactions take place, as opposed to a testnet used for experimentation. and the expansion of the validatorValidator A participant in a Proof of Stake network responsible for validating transactions and securing the network.A participant in a Proof of Stake network responsible for validating transactions and securing the network. set (via strict performance criteria) should reduce this dependence, but the challenge remains significant. The blockchain trilemmaTrilemma The blockchain scalability problem, balancing decentralization, security, and scalability. (SecuritySecurity The measures and technologies used to protect blockchain networks and assets from theft, fraud, and attacks., ScalabilityScalability The ability of a blockchain network to handle a growing number of transactions efficiently., Decentralization) will certainly not be solved tomorrow!

About stakingStaking The act of participating in a Proof of Stake network by locking up tokens as collateral to validate transactions and secure the network.

Recently, Hyperliquid opened the possibility for everyone to stake its $HYPE tokens. Staking is based on a Delegated Proof of StakeProof of Stake A consensus mechanism where validators are selected based on the number of tokens they hold and are willing to "stake" as collateral. (DPoS) model. Holders delegate their tokens to validators, who must lock up 10,000 $HYPE to participate in the consensus. Withdrawals involve a 7-day waiting period – a standard mechanism to protect against attacks. The rewards, derived from future $HYPE emissions, follow an Ethereum-inspired formula: the annual rate is inversely proportional to the square root of the total staked (≈2.37% at 400M $HYPE staked).

HyperBFT consensus requires a quorum of ⅔ of the staked tokens to validate blocks. Stakers must select trustworthy validators, as no automatic slashingSlashing A penalty mechanism in Proof of Stake networks where a portion of a validator's staked tokens is taken away for malicious behavior or failure to perform their duties. is implemented yet. However, failing validators can be jailed by vote if they fail to respond to queries, temporarily depriving them of rewards.

With the arrival of staking, the number of validators has nevertheless expanded (to see the validators live:https://hypurrscan.io/staking)

The protocol recently expanded its network from 4 to 16 validators, in order to reduce the centralization that was initially criticized. The protocol is targeting 50 validators by the end of 2025, and is accompanying it with an incentive program to attract independent participants, despite the challenges of the testnetTestnet A testing environment for blockchain developers to experiment with new features without risking real assets.. The goal is to secure the L1 while diversifying the players, essential to compete with established blockchains.

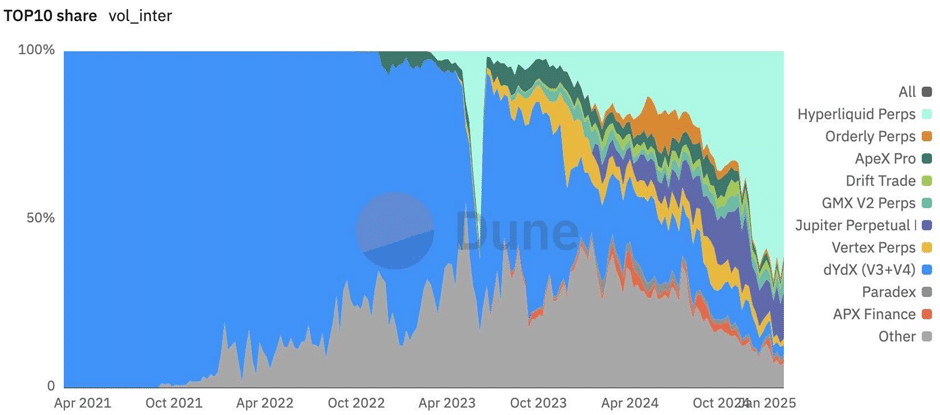

Why would you choose HL over another DEX?

- The ease of use of the platform, with a neat UI/UX.

- A platform that already welcomes large volumes and institutional traders, which promote increased liquidity.

- Almost complete transparency: all orders and liquidity are visible on the blockchain.

- The HLP vault, or the opportunity for users to take advantage of trading fees and liquidations, with an average APR consistently in double digits.

- A single transaction to activate trading, which notably allows the use of a LedgerLedger A record of all transactions on a blockchain, often managed in a decentralized manner. without signing each transaction.

- Advanced order execution capabilities (TWAP, Scale, etc.)

- Mobile trading made possible, without importing private keys to the phone.

- An internal oracle, which ensures consistent liquidation prices even in low liquidity areas, reducing the risks of manipulation.

- Fast and efficient listings of new trending tokens.

- A high-performance L1 enabling 0.2 second latency and 100,000 TPS throughput.

- Transparent spot listings, with a fair auction system

- Native DPoS staking

What’s next for HL?

Although the EVM has not yet seen the light of day at the time of writing this article, Hyperliquid embodies a new era where protocols become autonomous organisms. Each swap feeds the HLP, which feeds the buyback, which values $HYPE, which attracts more traders… A flywheel, certainly, but whose source of income we know (see Terra Luna).

With the arrival of native EVM, the protocol is preparing for its phase II: becoming the operating system for all on-chain markets. In this world, the boundaries between CEX and DEX, between traders and LPs, between capital and code – all of this disappears in favor of a pure algorithmically optimized financial flow.

Join Hyperliquid

Useful resources:

- Hyperliquid

- HyperliquidDocs

- Hyperscan

- Hyperliquid Foundation statistics page

- Hyperliquid staking dashboard

- HyperliquidDEX Testnet Homepage

- Dexscreener – Hyperliquid charts

- deBridge+HyBridge

- ASXN Hyperliquid analytics dashboard

- Hypurrdash Analytics Platform

- HyperScanner Hyperliquid Insights – Analytics

- DefiLama –Hyperliquid

- Nansen staking dashboard

- Directory and visualization of HL network

- Directory of resources for the Hyperliquid community

- Hypurrcollective ecosystem database

- Compilation of useful introductory content