Introduction

The vast world of finance has always been one of the most opaque fields, which is why most people not working in this area show little interest in it.

Without further ado, let’s start with the basics:

What is an option?

According to the AMFAMF The French Financial Markets Authority, the regulatory body for financial markets in France. (Autorité des Marchés Financiers): “Options are financial instruments known as ‘derivatives’ that give the right to buy or sell a quantity of underlying assets (stocks, currencies, cryptocurrencies, etc.) during a specified period and at a predetermined price. You pay a premium to acquire this right.”

You can exercise this right to buy (call) or sell (put) the underlying assetAsset Any digital asset, including cryptocurrencies. when you buy options, if it expires above your strike price in a call option or below it in a put option.

To simplify understanding, we will initially discuss only the buying and exercising of an option, meaning the right to buy or sell an underlying product. The selling of options will be covered later due to the associated risk and complexity, especially if you are not already familiar with derivative products.

Understand that the right to buy or sell can only be exercised if the strike price is reached or exceeded by the underlying asset’s price, and if the option actually expires on that day; otherwise, it expires worthless.

To make the concept more concrete, let’s look at an example:

On January 1, 2020, the cryptocurrencyCryptocurrency A digital currency based on cryptographic technology to verify and secure its transactions and control the supply. A blockchain is used to store transactions transparently and verifiably. $BTC is trading at $100 per unit. You believe that this valuation is unjustified and that the crypto should be worth at least $110 by the end of February.

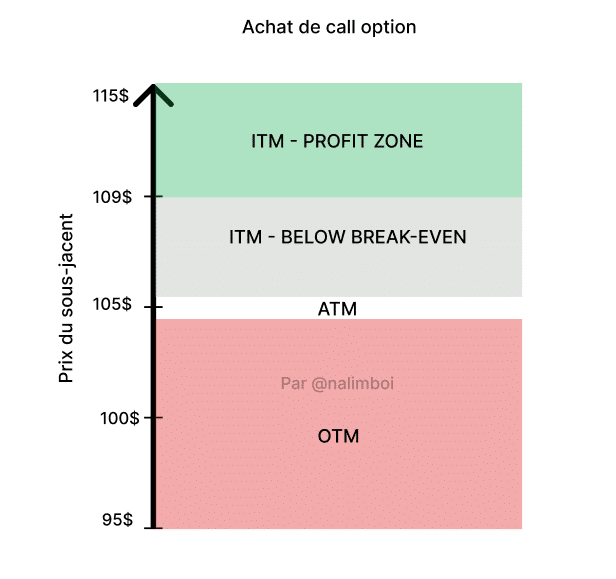

So you buy out-of-the-money (OTM) calls priced at $4 per crypto, with an expiration date of February 28, 2020, and a strike price of $105. You decide to purchase 1 lot (100 $BTC x $4) of calls, making an investment of $400.

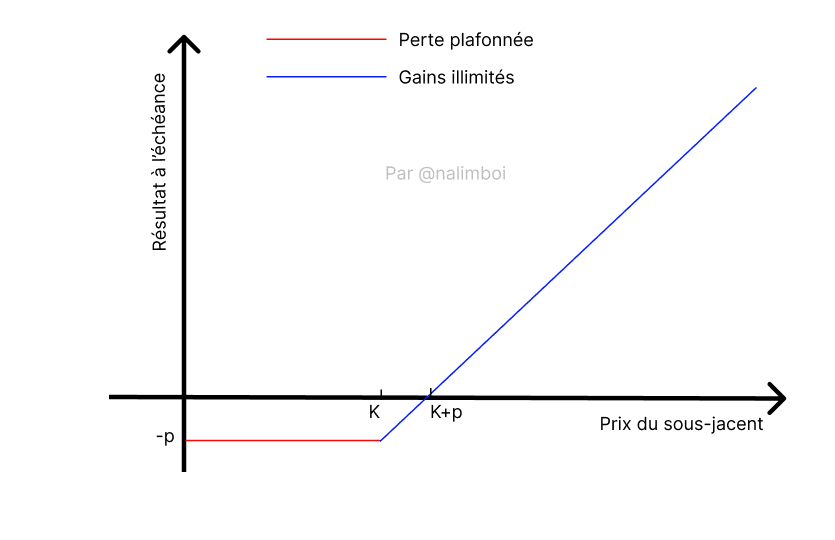

Now it’s February 28, and the crypto price has soared to $110, just as you predicted. You decide to exercise your right to buy 100 $BTC at $105 each and then sell these cryptos instantly at $110 per unit.

Since the premium is never refunded, even if you make a profit, you have realized a profit of (100 x $110 – 100 x $105 – $400) = $100.

Indeed, you had the right to buy cryptos at $105 when the price was $110. You bought a right and exercised it; nothing too complicated.

The profit is significantly higher than with a simple spotSpot A market where assets are bought and sold for immediate delivery. purchase. Using this example, to risk the same amount ($400), you would have had to buy 4 $BTC at $100 each and then sell them at $110 per unit, yielding a net profit of $40. In this case, you generated 2.5 times more profit by using options.

However, this notion needs to be tempered regarding the risk I mentioned: buying an option represents a total loss if it is not exercised, whereas a spot purchase would require the crypto to lose all its value for the losses to be equivalent. Financial markets being zero-sum games, there is no quick and easy way to make money. Keep this concept in mind if you want to perform well in the long term.

Understand that the profit from options arises from an additional variable that this product contains compared to traditional markets: time. You must not only be correct in your position but also in the timing of its realization; otherwise, you lose the entire invested amount (premium).

Let’s get back to our topic: to simplify, when you buy a put or call option, you are buying the right to buy or sell the underlying crypto if the option is In The Money (ITM) or At The Money (ATM). If it expires Out of The Money (OTM), it has no value and you gain nothing.

To clarify, let’s run a test:

On January 1, 2021, the cryptocurrency $ETH is priced at $200 per unit. Three traders have different opinions:

- The first believes $ETH is a bubble and is pessimistic, so they buy puts with a strike price of $100 with an expiration similar to the other two traders.

- The second is very optimistic and buys calls with a strike price of $300.

- The third is relatively optimistic and buys calls with a strike price of $250

Months pass, and expiration day arrives: $ETH is now worth $300.

The question is: Which trader’s position is ITM, OTM, and ATM? (One possible answer per trader)

The answer is at the end of the article.

Types of Options

There are two types of options: European and American. For now, we will only discuss the European type, as it seems more intuitive.

The difference between the two lies in the timing of exercising these options. A European option expires only at its expiration date, and the right to exercise it is accessible only at that precise moment.

In contrast, an American option can be exercised at any time from the purchase of the option. This is why American options are generally more expensive due to the flexibility they offer the holder.

Both types of options can be sold at any time before expiration.

Why Use Options?

Before explaining that, a bit of history:

Options were invented before 1752, when the first written account describing the organization of the Amsterdam Stock Exchange appeared in Voltaire’s Encyclopedia.

However, it was not until 1848 that options became truly popular, this time across the Atlantic in Chicago. The first exchange for regulated derivatives that recorded significant transaction volumes emerged: the CBOT (Chicago Board Of Trade).

Today, the CBOT has become the CME (Chicago Mercantile Exchange) and is one of the world’s foremost financial centers, both historically and in terms of its functional importance.

Options have always been extremely useful tools in the eyes of financiers, and this is one of the reasons why these products are so popular today. Indeed, options cover a significant portion of financial transactions due to their versatility.

Here are a few examples:

-

-

- Options allow for hedging against unpredictable or violent marketMarket A place where assets are bought and sold. movements. For instance, if you are an investment fund holding a large amount of Total shares, you might have a concrete interest in buying puts on oil prices. In this case, the underlying asset is different, but the logic can apply to similar assets. For example, a farmer wishing to protect against wheat price fluctuations can do the same.

- Additionally, options allow for precise speculation on asset movements by quantifying risk. By adding the variables of time and volatilityVolatility The degree of variation in an asset's price over time., if you have a high conviction about these factors (for instance, if you think volatility will be lower in summer), the returns you can generate using options will be higher than those from a spot purchase or a short sale.

- Finally, the concept of arbitrageArbitrage Exploiting the price difference between two markets to make a profit. represents another potential use of these financial products. Market participants who identify anomalies can use options to exploit differences in quotations, just like futuresFutures A contract to buy or sell an asset at a predetermined price in the future. and forwards.

-

Answer to the Exercise:

-

-

- OTM (Out of The Money), 2. ATM (At The Money), 3. ITM (In The Money)

-