How to Minimize Rugs

When you dive into the world of shitcoins, you need to understand that it’s like a casino on steroids—except you can also get robbed if you’re not careful. That’s probably why you’re here (aren’t we all?). The lure of big profits is irresistible, but it’s better to approach it with some safety rules and an eye for spotting the main red flags.

Disclaimer: Not everything is black and white in this space. It’s a world full of subtleties and sharks, so don’t expect to have a perfect win rate or avoid all rugs.

You will inevitably get rugged in your quest for a 1000x—it would be foolish to think you can dodge every scam.

The goal is simply to avoid the obvious scams and maximize your chances. That’s it.

There are tons of insiders in this space, and some days you win, some days you lose.

So, don’t get down on yourself on the bad days when you see others making huge multipliers.

Some Red Flags and tools to help you :

Copy/Paste Contracts: Use Tokensniffer

We’re not necessarily looking for tokens with tons of mechanisms, but when it’s a cheap copy-paste job with no modifications, the lack of effort is often a strong red flag for potential rugs. Tokensniffer allows you to compare the contract you’re looking at with others and shows you any copies. This will save you from buying the 15th rug from some shady dev just because a frog pfp on Twitter recommended it.

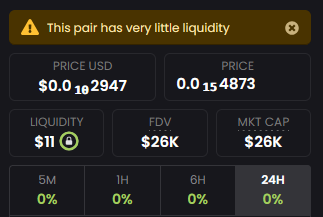

Low LiquidityLiquidity The ease with which an asset can be bought or sold without affecting its price.

Low liquidity is often a bad sign. You can check basic practices on Tokensniffer, like the liquidity pool (LP), the holders, and whether some wallets, like the creator’s, hold more than 5% of the liquidity. This can help prevent the creator from suddenly pulling the liquidity.

Deployers Linked to Rugs

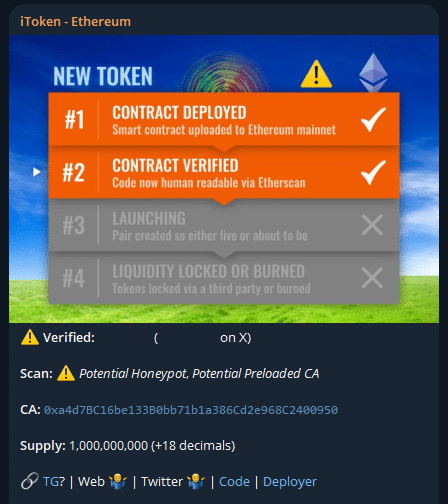

Some shady devs don’t even bother hiding their tracks and deploy rugs from the same addressAddress A unique string of characters that identifies an entity or account on a blockchain network, allowing the sending and receiving of cryptocurrencies.. While it’s not extremely common, it happens often enough to mention. That said, just because a contract address isn’t linked to other tokens doesn’t mean you’re safe—some people are smarter and sneakier than others. Use XCatcher, iToken, and Ottobots for your safety. Ottobots lets you simulate trades with a contract address and gives you stats on the tokenToken A digital asset issued on a blockchain, representing various utilities, rights, or value..

iToken

iToken gives you all sorts of useful details with just the contract address, including the pair, supply, anti-scam scans, project networks, contract code, deployer address, a scan of holders, contract deployment status, pair launch status, and whether liquidity is locked/burned, etc.

Disclaimer: These aren’t guarantees. It’s possible that these tools could change ownership or go offline, so keep your eyes open for new tools like these to stay up to date.

Relaunches

Relaunches are generally a bad sign. They don’t always mean bad intentions, but usually, the hype is gone by the time a token is relaunched—unless it’s highly anticipated.

Trend Variants

Tokens like baby___, pepe___, doge___, shiba___, ____wifhat and other variants are generally not a good sign. But hey, everyone’s got different tastes and risk appetites. You can also choose to get in & out extremely fast, and that could work, but don’t get too greedy !

Calls by Random Influencers

When you see calls from influencers, understand that they’ve already bought before you, usually at a much better price. They need exit liquidity, and when you buy, you’re providing it. Of course, there might be some good plays that happen by chance, but in low/micro caps, it’s always risky, so be cautious.

The Team Posts Charts

A solid team focuses on the product itself—its features, the future of the project—not on price movements.

It’s generally a bad sign when a founder or team talks about price.