Les AMMs sont les piliers algorithmiques qui soutiennent l’infrastructure des échanges décentralisés (DEXs) dans l’univers de la finance décentralisée (DeFiDeFi Les services DeFi utilisent des smart contracts, des protocoles décentralisés et des jetons pour offrir une gamme de services financiers qui peuvent parfois remplacer ceux proposés par les banques, tels que le prêt/emprunt, la gestion d'actifs, l'assurance ou l'échange d'actifs.).

Ces mécanismes automatisés révolutionnent la façon dont les actifs sont échangés en ligne en offrant une alternative innovante aux modèles traditionnels de carnet d’ordres, éliminant le besoin d’acteurs centralisés pour faciliter les échanges.

Dans la finance traditionnelle, les marchés sont gérés par des entités privées, comme le New York Stock Exchange (NYSE). Le NYSE permet aux participants d’échanger sur le marché secondaire pendant des heures de trading définies. La liquidité est fournie par l’offre et la demande, ainsi que par le travail des spécialistes du marché (Designated MarketMarket Lieu où les actifs sont achetés et vendus. Makers) et des courtiers de parquet.

Qu’est-ce qu’un AMMAMM Un algorithme utilisé dans les plateformes de négociation décentralisées (DEX) pour fournir de la liquidité à l'aide de pools. Les fournisseurs de liquidités déposent dans ces pools et reçoivent une part des frais générés par les transactions. L'algorithme détermine le prix de l'actif en fonction de l'offre et de la demande dans le pool. ?

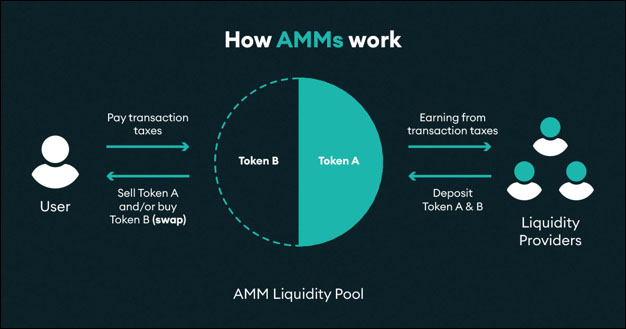

Un AMM est un protocole qui permet l’échange automatique et décentralisé d’actifs numériques. Les AMMs utilisent des algorithmes mathématiques et des pools de liquidité prédéfinis pour faciliter les échanges.

Comme le marché est régi par des algorithmes autonomes et une provision de liquidité intermittente, il n’y a pas d’heures de trading spécifiques, et les échanges peuvent avoir lieu à tout moment. Sans autorité centralisée pour approuver ou désapprouver les échanges ou la provision de liquidité, n’importe qui peut interagir avec la plateforme.

Cela signifie également qu’aucun professionnel n’est requis pour assurer la bonne garantie et la liquidité des paires, donc trader sans vérifier les deux points suivants peut être risqué :

- Vérifier les Tokens : Des créateurs de tokens frauduleux peuvent produire de faux tokens avec des noms similaires pour tromper les acheteurs. Il est essentiel de vérifier l’adresse du contrat du tokenToken Un actif numérique émis sur une blockchain qui représente divers services publics, droits ou titres. (lien officiel depuis le site du projet ou Twitter, et vérifier la cohérence avec la liquidité et la capitalisation affichées).

- Problèmes de Liquidité : Pour les tokens moins connus, la liquidité peut être faible (faible volume, moins attractif pour les fournisseurs de liquidité), et l’achat ou la vente d’un montant important pourrait entraîner un slippageSlippage La différence entre le prix attendu d'une transaction et le prix réel auquel elle est exécutée, qui se produit souvent pendant des périodes de forte volatilité ou de faible liquidité. substantiel (le prix réel de l’échange peut différer du prix indiqué en raison d’une offre insuffisante de contrepartie au prix souhaité).

Pools de Liquidité

Les pools de liquidité sont au cœur des AMMs. Ils consistent en des paires d’actifs déposés par les utilisateurs, connus sous le nom de fournisseurs de liquidité (LPs). En échange de leurs dépôts, les LPs gagnent des frais de transaction générés par les échanges effectués dans le pool.

Pour une compréhension détaillée de la provision de liquidité, voir les articles sur le staking et le lending et l’impermanent loss.

Modèles Algorithmiques

Plusieurs modèles algorithmiques sont utilisés par les AMMs, le plus populaire étant le modèle Constant Product Market MakerMaker Une entité qui fournit de la liquidité à un marché en plaçant des ordres limités. (CPMM), basé sur la formule : x⋅y=k où x et y sont les quantités des deux actifs dans le pool, et k est une constante.

Les autres modèles algorithmiques incluent :

- Constant Sum Market Maker (CSMM)

- Constant Mean Market Maker (CMMM), utilisé par Balancer

- Advanced Hybrid Constant Function Market Maker (CFMM), utilisé par PancakeSwap

- Dynamic Automated Market Maker (DAMM)

Les AMMs notables incluent Uniswap, PancakeSwap, Osmosis, et CurveDAO.

Avantages et Défis

Les AMMs offrent une liquidité permanente, facilitent l’accès et la participation au marché, et réduisent les coûts et délais de transaction. Cependant, ils présentent également des défis tels que l’impermanent loss, où les fournisseurs de liquidité peuvent voir la valeur de leurs actifs déposés diminuer en raison des fluctuations de prix.

Pour résoudre ce problème, certains DEXs ont dû se réinventer. Par exemple, Uniswap, le DEXDEX Plate-forme d'échange décentralisée sans autorité centrale, qui utilise souvent des AMM pour permettre les transactions. leader sur Ethereum, a introduit une nouvelle version :

- Uniswap V3 : Les LPs peuvent concentrer leur liquidité dans des fourchettes de prix spécifiques, contrairement aux versions précédentes où la liquidité était distribuée sur toute la courbe de prix. Cela permet aux LPs de fournir de la liquidité uniquement dans les fourchettes de prix où ils s’attendent à ce que la plupart des échanges se produisent, augmentant ainsi l’efficacité du capital.

Exemple : Supposons qu’un LP veuille fournir de la liquidité pour une paire ETH/DAI. Au lieu de répartir leur capital sur toute la courbe de prix, ils peuvent le concentrer entre 1 000 et 2 000 DAI par ETH, maximisant ainsi les rendements si la plupart des échanges se produisent dans cette fourchette. - Frais Flexibles : Uniswap V3 introduit des frais flexibles, permettant aux LPs de choisir parmi trois niveaux de frais différents pour compenser les risques associés à chaque paire de trading. Cela permet aux LPs d’adapter leurs stratégies en fonction de la volatilité attendue de la paire de trading.

- Oracles Améliorés : Les oracles d’Uniswap V3 sont optimisés pour calculer le prix moyen pondéré dans le temps (TWAP) plus efficacement et sur des périodes plus longues, facilitant l’intégration et l’utilisation par d’autres protocoles DeFi.

- Liquidité Non-Fongible : Dans Uniswap V3, les positions de liquidité sont représentées par des tokens non-fongibles (NFTs), reflétant la nature unique de chaque position de liquidité due à la capacité de spécifier des fourchettes de prix.

Conclusion

Les AMMs représentent une avancée technologique majeure dans la DeFi en automatisant et démocratisant l’accès aux échanges d’actifs numériques. En comprenant les mécanismes et algorithmes qui les sous-tendent, les utilisateurs et investisseurs peuvent profiter de plusieurs opportunités :

- Acheter ou vendre des tokens sans attendre qu’ils soient listés sur un exchange centralisé, et sans avoir besoin de l’approbation de l’exchange. Des bots (comme Unibot, Maestro) sont même disponibles pour investir lors des nouveaux listings de paires.

- Mettre en place des stratégies de farming et faire fructifier les cryptomonnaies détenues.