How to Filter Out Grifters?

As in any space where money flows in, the crypto space is filled with many sharks who are trying to make money at any cost, regardless of ethics or practices.

Fortunately, there are many recognizable patterns and precautions you can take to avoid them.

Like in a game of Werewolf, it’s up to you to determine who is on your side, who wants to take advantage of you, analyze people’s intentions and why, and draw conclusions from behaviors and what you see every day.

To do this, you’ll need to DYORDYOR The encouragement to conduct independent research before investing. Often posted as a disclaimer, it is what is written in every investment disclaimer because it is essential to inform yourself before investing., the famous “Do Your Own Research.”

Seems obvious, but you need to learn how to do that.

What should you check?

It all depends on what you’re investigating, whether it’s a NFTNFT A unique digital asset representing ownership of a specific item, often used for digital art, collectibles, and other digital assets. project, a tokenToken A digital asset issued on a blockchain, representing various utilities, rights, or value., an influencer, etc.

For a Project:

The Team (Anonymous or Doxxed?)

The first and most important element: who are the project’s founders?

Who has control over your potential investment and can either make it a success or send it instantly to 0 ?

Are they experienced, do they communicate well, do they seem serious, and do they often meet the announced deadlines?

What is their track record?

Founders’ Track Record and Networks

What kind of profile do the founders have?

Are we dealing with a discreet nerd (or an anonymous profile picture) or someone flaunting big muscles, Lambos, watches, Dubai jet skis, and bottles in clubs, for example?

What type of communication do they use on their social media?

This is not an extremely relevant argument, but it is an initial clue about their behavior and what might follow in terms of the project.

Furthermore, even after a scam, many grifters do not bother changing their identity (mainly because they already have a naive fanbase, and the collective memory on Crypto Twitter is about five minutes).

Therefore, they don’t have much incentive to do so, unless they have really gone too far, especially with moves that have serious legal consequences.

In the most common cases, a quick search using the “@” on Twitter is often successful, especially regarding their previous projects.

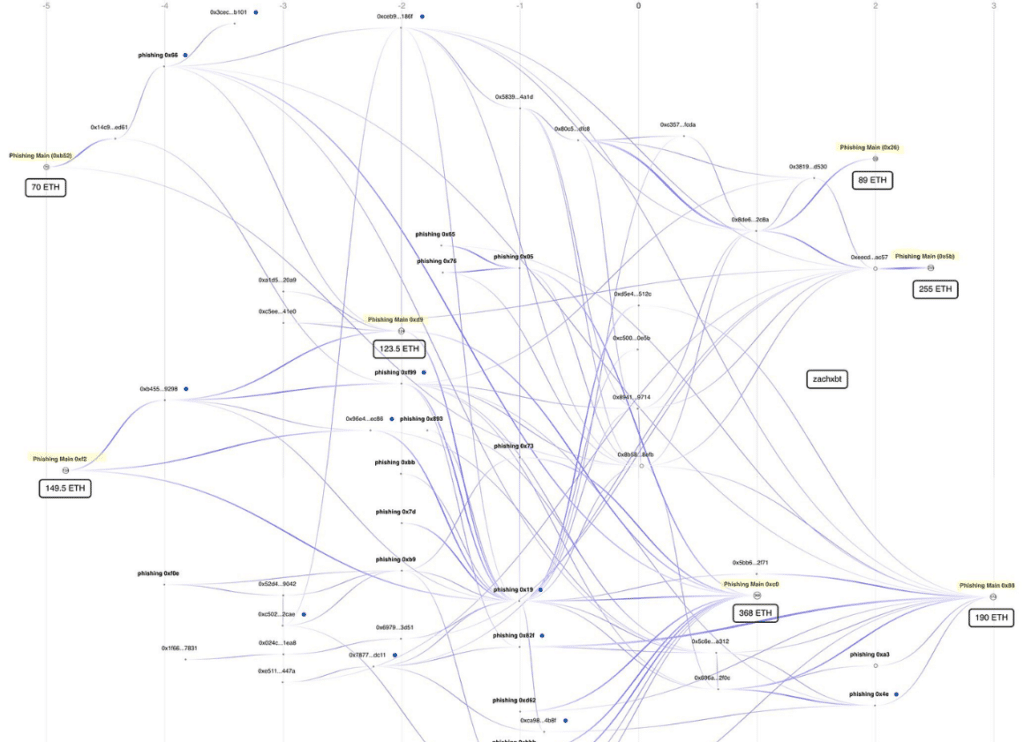

A search with tags from on-chain investigators, such as @zachxbt, can also provide you with a lot of information.

You can also search their username on major Discords to see the general opinion of the community.

Founders’ Wallets (Often Easily Doxxable)

Sometimes social networks are clean, but on-chain traces remain.

You know the quote, “Don’t trust, verify.”

If you can find the walletWallet A tool used to store, send, and receive cryptocurrencies., particularly from a token purchase or an NFT posted, for example, you can then check links with other wallets, other buys/sells, whether they sell after tweeting, etc.

Project’s Social Networks (Botted or Organic)

Simple but easy to verify: if you go to a Twitter account and click on the number of followers, a list will appear. Just scroll and see if you see many nonsensical names, with very few tweets, often no profile photo, few followers, and names in Thai/Indonesian, etc.

If you don’t see the “followed by X people you follow” option, it’s either because you’re very early or, usually, a bad sign if you have a quality timeline.

For an Influencer:

Aside from what was already mentioned above, you can check:

Their Social Media Accounts

What do they show on them? What is the general opinion about this person?

We see less of this in crypto (at least not native crypto), but be very wary of influencers who are dreamsellers, displaying luxury, travel, expensive cars, watches, etc.

They tend to make a comeback and are very present during bull markets, with promises of easy money.

In crypto, it’s more about screenshots of large PNLs (Profit and Loss) and an invitation to join a paid group, as this works best and keeps coming back because people think they’ll get easy money by copying trades.

Their Real Name, If Findable, + Google

For some, you can find their real name, and thus often their previous experiences, which can lead you to juicy information.

Their Detractors

What better source of information to start digging than the person’s detractors?

They will do some of the investigative work for you, and sometimes everything is already laid out. Then, it’s up to you to verify that it’s not fabricated evidence, but overall, the work is often well done.

A simple search with the “@” and some keywords like refund, scam, holders can already tell you a lot.

Track Record

Is this influencer into trading, NFTs, or shilling projects?

As mentioned earlier, what is their track record?

If you really want to check, you can take note of the positions they take and the results, the projects they shill, with date and time, allowing you to compare with the charts.

You’ll quickly find out, as many of them believe that a deleted tweet is a tweet that never existed.

People They Interact With

Scammer recognizes scammer.

Of course, we’re not going to make hasty judgments, but they often supportSupport A price level where buying pressure is expected to be strong enough to prevent further price declines. each other in the space, and some even work hand in hand.

Again, no light accusations, especially since in many cases, it’s quite easy to find evidence by checking tweets/YouTube videos/wallets.

Shared Content and Behavior

Paid Groups, Trainings? (Authority Argument Because They Are Friends with X or Y)

The most important thing: what is being shared ?

Is there an intention to sell something ?

If so, what is it, and what is the legitimacy behind it?

For example, the classic one, as mentioned above for traders, is screenshots of large PNLs leading to an invitation to join a paid group to make millions yourself.

Of course, you won’t earn anything, and they will just farm the subscription fee + possibly affiliate marketing on you.

Project shilling on Twitter, “this is alpha, trust me,” is generally already too late; you will serve as exit liquidityLiquidity The ease with which an asset can be bought or sold without affecting its price. in 90% of cases, to put it nicely.

Overall, the only type of paid content where you might come out ahead is educational with guidance, but even then, it’s only if you’re invested, willing to learn, and they are good educators.

It’s quite rare to meet all these conditions.

Many are clever and use their friendships and associations as an authority argument to establish legitimacy, so be careful.

While there are many grifters, this is obviously not the case for everyone, and you need to know how to differentiate between people who want to sell useful services and scammers.

There are many interesting and worthwhile tools in crypto, which have nothing to do with paid groups and courses from some grifters.

So, be cautious but not paranoid or disparaging about every paid content.