What is crypto miningMining The process of validating transactions and securing a blockchain network through computational work.?

Think of blockchainBlockchain A public and immutable ledger of cryptographic transactions, organized in blocks. as a digital ledgerLedger A record of all transactions on a blockchain, often managed in a decentralized manner.. Each page of this ledger contains transactions, much like your bank statement lists all your expenses.

Miners are like the accountants of this ledger. Their job is to verify that each new transaction is valid before adding it to the ledger. To be allowed to add a page (called a “blockBlock A fundamental element of a blockchain, containing a set of transactions.”), miners must first solve a very complex mathematical puzzle, which is really a competition: the first miner to find the solution wins the right to add the next block to the chain.

It’s comparable to a situation where each miner is a detective trying to find the combination to a padlock. They try millions of possible combinations until one of them finds the right one. Whoever unlocks the padlock first gets the privilege of adding the latest transactions to the blockchain. And as a reward for their work, they receive brand new, freshly minted units of the crypto, as well as the transaction fees paid by users.

In fact, this puzzle-solving race is essential to keep the blockchain secure and reliable without the need for a central authority like a bank. Since the mathematical challenge requires a lot of computing power, it becomes very difficult and expensive for a fraudster to cheat and add fake transactions.

Additionally, once a block is added by a miner, all other miners and users can verify that it is correct. It is like having thousands of accountants checking every page of the ledger. If everyone agrees, the block is permanently linked to the chain and cannot be changed.

So, thanks to the hard work of miners solving these cryptographic puzzles, one can trust the accuracy and securitySecurity The measures and technologies used to protect blockchain networks and assets from theft, fraud, and attacks. of the blockchain, without having to trust a single central authority. That’s the beauty of a decentralized system!

Of course, in reality mining involves complex technical details, which are covered in this article.

This verification and recording work is essential to ensure the integrity, security and sustainability of blockchain networks. Without miners, it would be impossible to guarantee the reliability of transactions and avoid multiple spending of the same crypto unit. Mining is therefore an essential cog in the distributed consensusConsensus An agreement among blockchain participants on the validity of transactions. It is a key concept, essential for ensuring that all nodes on a chain share the same information. mechanism that characterizes blockchain networks.

The technical foundations of mining

Crypto mining is based on a fundamental principle called “PoW” (Proof of WorkProof of Work A consensus mechanism where miners compete to solve complex mathematical problems to validate transactions and secure the network.). To add a new block of transactions to the chain, miners must solve a complex mathematical problem that requires considerable computing power. This cryptographic puzzle, specific to each block, is designed to be difficult to solve but easy to verify once the solution is found.

In concrete terms, miners use the power of their computers to repeatedly generate cryptographic hashes until they obtain a result lower than a target value determined by the protocol. This trial-and-error process, which can require billions of calculations, ensures that substantial work has been done to create the new block. Once the problem is solved, the miner transmits its solution to other nodes in the network, which can then quickly verify its validity and add it to their copy of the blockchain.

Indeed, to fraudulently modify an existing block, an attacker would not only have to redo the work associated with that block, but also catch up with and surpass the work provided by all other miners on subsequent blocks, which is considered practically impossible.

What is hashHash A cryptographic function that converts input data into a fixed-size alphanumeric string. rate ?

Hashrate is a fundamental metric that measures the computational power of a blockchain network. It represents the number of hash operations that a miner or the entire network can perform per second. For example, a hashrate of 100 TH/s means the system can perform 100 trillion (1012) hash calculations every second. When an individual miner or mining pool reports their hashrate, it indicates their relative strength and probability of finding the next block. The global network hashrate, which is the sum of all mining power across the network, serves as a key security indicator.

As the network’s total hashrate increases, the mining difficulty automatically adjusts to maintain a consistent average block time – approximately 10 minutes for Bitcoin. This dynamic relationship between hashrate and difficulty is crucial for network security: a higher hashrate means an attacker would need an enormous amount of computational power (and thus financial investment) to successfully execute a 51% attack51% Attack An attack on a blockchain where a malicious actor holds more than 51% of the hashing power, allowing them to manipulate transactions..

Modern mining operations measure their hashrate in different units depending on their scale: MH/s (megahash, 106), GH/s (gigahash, 109), TH/s (terahash, 1012), or even PH/s (petahash, 1015) for large mining pools.

Required infrastructure and equipment

The tools used for crypto mining have evolved considerably since the advent of Bitcoin in 2009. In the early days of the technology, it was still possible to mine with a simple personal computer. However, as mining difficulty increased and dedicated hardware became available, this approach quickly became obsolete.

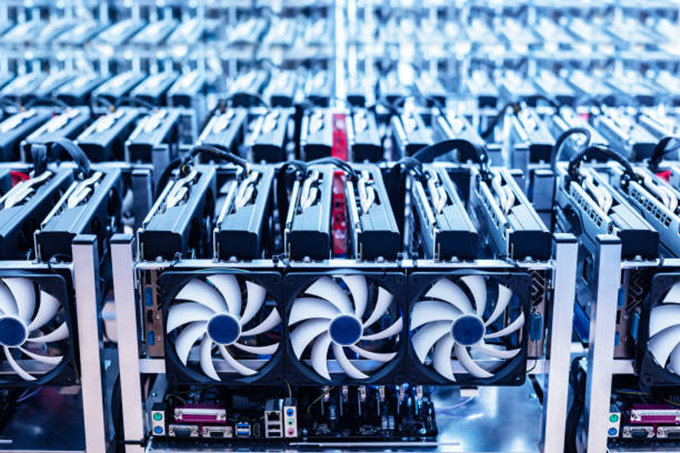

Miners have gradually turned to powerful graphics cards (GPUs), capable of performing a large number of calculations in parallel. This race for power then led to the development of specific integrated circuits, called ASICs (Application-Specific Integrated Circuits), optimized for mining a particular crypto. ASICs offer energy efficiency and computing power far superior to those of GPUs.

At the same time, the rise of mining has encouraged the emergence of mining pools, which allow individual miners to pool their resources and share rewards proportionally to their contribution. This pooling of labor has become essential to maintain a reasonable probability of finding a block and receiving regular compensation, in the face of competition from large industrial players.

Economics and profitability of mining

To understand the economics of crypto mining, it is essential to consider the costs associated with this activity. In addition to the initial investment in mining hardware, which is often substantial, miners must assume significant operating costs, chief among them electricity and maintenance.

Given these expenses, the profitability of mining depends mainly on two factors: the price of the mined crypto and the reward given to miners for each block created. For Bitcoin, this reward is currently 6.25 bitcoins per block, but it is scheduled to decrease by half every 210,000 blocks (approximately every 4 years), a process called “halving”.

Beyond the block reward, miners also collect transaction fees associated with the operations they validate. These fees, paid by users to speed up the processing of their transactions, can represent a significant portion of miners’ revenue when the network is congested.

While the principle of mining is common to most cryptos, its implementation and evolution vary depending on the network. Bitcoin and Ethereum, the two largest cryptos in terms of capitalization, illustrate these differences well.

For Bitcoin, mining relies on the SHA-256 hashing algorithm and remains largely dominated by ASICs. The concentration of mining power in the hands of a few large pools raises questions about how decentralized the network really is.

Ethereum, for its part, uses the Ethash algorithm, designed to be more resistant to ASICASIC A type of mining hardware specifically designed for certain cryptocurrencies, more efficient than GPUs and CPUs. dominance. However, Ethereum’s real innovation lies in its plan to transition to an alternative consensus mechanism, PoS (Proof of StakeProof of Stake A consensus mechanism where validators are selected based on the number of tokens they hold and are willing to "stake" as collateral.). With this new model, the creation of blocks and the validation of transactions no longer depends on computing power but on the holding and stakingStaking The act of participating in a Proof of Stake network by locking up tokens as collateral to validate transactions and secure the network. of ethers, the network’s native crypto.

At the same time, many projects are exploring solutions to make mining more fair and sustainable. Some are developing hybrid consensus algorithms, combining PoW and PoS. Others are betting on more radical approaches, such as permissioned mining or mining based on alternative resources (storage, bandwidth).

How do mining pools work in practice?

A mining pool is a group of miners who pool their computing resources to increase their chances of finding blocks. Instead of each working in isolation, miners in a pool combine their power to collectively solve the cryptographic puzzles of the blockchain. When a block is found by the pool, the reward is shared among all participants in proportion to their contribution.

The advantage of pools is that they allow miners’ income to be smoothed. Indeed, in a blockchain like Bitcoin, the reward for a block is awarded in a “winner-takes-all” manner: only the miner who finds the block pockets the newly created bitcoins and transaction fees, the others leave empty-handed. With a pool, the gains are certainly less spectacular, but much more regular and predictable.

Mining pools have quickly gained popularity, to the point where they now represent the vast majority of the computing power of the Bitcoin network. Major pools such as Antpool, F2Pool or ViaBTC bring together tens of thousands of individual miners and professional mining farms.

To counter the 51% threat, some cryptos have opted for “ASIC-resistant” hash functions, i.e. designed to be inefficient to implement on specialized circuits. This is the case, for example, of Monero, which uses the RandomX algorithm to favor mining on CPUs and thus promote greater decentralization. Others, such as Litecoin, rely on Scrypt, a memory-intensive function supposed to advantage GPUs over ASICs.

But despite these attempts, the underlying trend remains towards the professionalization and industrialization of mining. Giant farms are multiplying, often installed in regions with very low electricity costs such as China, Russia, Iceland or Kazakhstan. Listed companies such as Riot Blockchain or Hut 8 Mining are investing massively in dedicated infrastructures, with tens of thousands of ASICs running at full speed 24 hours a day.

This development raises questions about the accessibility and decentralization of mining, which increasingly seems to be reserved for a handful of players with considerable resources.

Economics and profitability of mining

Beyond its energy and environmental issues, crypto mining is also an eminently economic activity, the profitability of which depends on a complex set of parameters. To understand the driving forces of this business, it is useful to analyze its main cost and revenue items.

In terms of costs, the biggest item is undoubtedly electricity. As we have seen, running thousands of ASICs 24 hours a day consumes phenomenal amounts of energy, which often represent more than 80% of the operating costs of a mining farm. As an example, a latest generation Antminer S19 miner consumes approximately 3,250 watts for a power of 100 TH/s, or an annual bill of more than $3,000 per device with an electricity rate of $0.10 per kWh.

This is why the location of mining farms is a major strategic issue. To optimize their profitability, miners seek to set up in regions where electricity is as cheap as possible, even if it means frequently relocating their operations as opportunities arise. This is how countries such as China, Russia, Kazakhstan and Iran have become mining hubs, thanks to their significant hydroelectric resources and very low prices (sometimes less than $0.03 per kWh).

But energy costs aren’t the only consideration. There’s also the initial investment in hardware, which can quickly add up to millions of dollars for an industrial-scale farm. A high-end ASIC miner costs between $5,000 and $10,000 each today, and hundreds or even thousands of them need to be deployed to be competitive. Not to mention the infrastructure needed to host them: buildings, cooling systems, network connections, maintenance, security, etc.

Another key factor is the lifespan and obsolescence of equipment. In the ultra-competitive world of mining, a state-of-the-art ASIC can become obsolete in a matter of months, supplanted by ever more powerful and efficient models. To stay in the race, miners must therefore constantly renew their fleet, which reduces their profitability and generates a mountain of electronic waste that is difficult to recycle.

In terms of revenue, the mining business model is based on two pillars: block rewards and transaction fees. When a miner manages to create a new valid block, he receives a double remuneration: on the one hand, a fixed amount of newly issued cryptos (today 6.25 bitcoins per block); on the other hand, the sum of the fees included in the transactions he has chosen to include in his block.

While block rewards currently represent the majority of miners’ income, their amount is expected to decrease over time. Indeed, most cryptocurrencies provide for a “halving” mechanism that halves the block reward at regular intervals, in order to control inflation and the speed of tokenToken A digital asset issued on a blockchain, representing various utilities, rights, or value. issuance. For Bitcoin, the last halving took place in May 2020, reducing the reward from 12.5 to 6.25 bitcoins. The next one is scheduled for 2024, then 2028, 2032, etc. until the entire supply of 21 million bitcoins is in circulation.

Ultimately, transaction fees are therefore expected to take over to ensure the profitability of mining. But this transition is far from being a given. Indeed, fees currently represent only a minority share of miners’ revenues (less than 10% for Bitcoin), and their amount is very volatile because it depends on network congestion and the willingness of users to pay more to see their transactions processed as a priority.

In addition, the increase in fees poses an accessibility and scalabilityScalability The ability of a blockchain network to handle a growing number of transactions efficiently. problem for cryptos. If each transaction costs several dollars or even tens of dollars, as was the case during the peaks of activity in 2017 or 2021, this makes their use impractical for everyday payments and risks confining them to a role as a store of value or speculative assetAsset Any digital asset, including cryptocurrencies.. This is one of the major challenges of PoW blockchains: how to maintain the security of the network without hindering its adoption?

Another essential parameter is the choice of cryptos to mine. Not all protocols offer the same profitability, depending on their hashing algorithm, their mining difficulty, their monetary policy and of course their valuation on the markets. If Bitcoin remains the king in terms of gross revenue, some altcoins can be more interesting in terms of return on investment, because they are less competitive and easier to mine with generic hardware.

This is the case, for example, of Ethereum Classic, Monero, Zcash, Grin or Beam, which use ASIC-resistant and GPUGPU A graphics card component that can be used to mine cryptocurrencies by performing the calculations needed to validate transactions. More powerful than a CPU for certain types of calculations.-friendly memory-hard algorithms. Mining these alternative cryptos can make obsolete hardware profitable for Bitcoin, reduce energy and equipment costs, and position themselves on promising but still under-the-radar projects. Many miners are also exploring the opportunities offered by non-minable tokens such as those from PoS blockchains, by participating in their ICOs or offering validation services.

There are many online tools to help miners calculate the profitability of different scenarios and optimize their resource allocation, such as WhatToMine, CoinWarz, CryptoCompare, or NiceHash. These calculators take into account dozens of parameters such as hashrate, power consumption, energy cost, network difficulty, block rewards, and transaction fees to estimate the potential revenue and ROIROI The percentage return on an investment relative to its cost. of a given setup.

But beyond the tools, it is above all a detailed knowledge of the sector and a constant watch on its developments that make good miners. Because even more than technology, it is the human factor that remains decisive in this constantly changing industry.

Specificities

While mining Bitcoin and the main PoW cryptos share many common points, there are also important specificities linked to the technological and economic choices of each project.

Let’s start with Ethereum, which remains the leading alternative to Bitcoin in terms of valuation and adoption to this day. Since its creation in 2015, Ethereum has used a hashing algorithm called Ethash, which aims to be resistant to centralization and to favor mining with GPUs rather than ASICs. The idea is to allow as many people as possible to participate in securing the network, without favoring large pools with dedicated hardware.

This worked for a while, but as the price and difficulty increased, Ethash ASICs eventually appeared on the marketMarket A place where assets are bought and sold., produced in particular by the Chinese giant Bitmain. To counter this trend, Ethereum developers regularly modified the algorithm via hard forks, in order to make existing ASICs obsolete. This was the case, for example, with “The Merge” in late 2020, which integrated a new algorithm called “Muir Glacier” to delay the “difficulty bomb” that threatened to make GPU mining unprofitable.

But these adjustments are only temporary patches. The real revolution for Ethereum is planned with the transition from PoW to PoS, via a major update initially called Ethereum 2.0 and now The Merge. The idea is to replace miners with validators who stake their ethers for the right to create blocks and receive the associated rewards. This system promises to be much more energy efficient, since it does not rely on intensive calculations but on incentive tokenomicsTokenomics The study of the economics and supply dynamics of a cryptocurrency or token..

The transition to PoS is a titanic project that has mobilized the Ethereum community for several years. It involves developing a new parallel blockchain (the “beacon chain”), testing its operation in real conditions, gradually migrating applications and assets, and coordinating the various players in the ecosystem. A complex and pitfall-filled process, which has encountered many delays but which finally seems to be on the verge of completion.

But there are also cryptos that assume and claim PoW, seeing it as the best guarantor of security and decentralization. This is the case, for example, of Monero, which stands out for its radical approach to confidentiality. Unlike Bitcoin where all transactions are traceable on a transparent blockchain, Monero uses ring signatures and stealth addresses to hide the origin, destination and amount of funds exchanged.

To prevent a powerful actor from compromising this confidentiality by taking control of mining, Monero relies on an anti-ASIC algorithm called “RandomX”. Its principle is to randomly use the set of processor instructions, in order to favor classic CPUs and GPUs rather than specialized chips. RandomX is optimized to take advantage of the latest features of modern processors, such as the AVX2 and AVX512 instruction sets, the branch predictor or L3 memory.

The goal is to democratize mining and make it accessible to as many people as possible, including with consumer or recycled hardware. A conscious choice, which slows down the race for performance and centralization but which guarantees better network resilience. In the spirit of Monero, it is better to have thousands of small CPUCPU The processor of a computer, a component that in crypto can be used to mine blocks by performing intensive calculations to validate transactions and secure the network. miners spreadSpread The difference between the highest bid price and the lowest ask price on a market. around the world rather than a handful of giant farms controlled by an elite.

This philosophy is found in other projects like Vertcoin, which relies on the “Lyra2REv3” algorithm to promote fair mining, or Ravencoin which uses “KAWPOW” to give a second life to old graphics cards. But there are also cryptos that seek to overcome the opposition between ASIC and GPU, by proposing hybrid algorithms that combine the best of both worlds.

This is the case, for example, of Dash, which uses a system of “masternodes” to offer advanced services such as instant transactions (InstantSend) or confidential payments (PrivateSend). Masternodes are full nodes that must hold a minimum amount of Dash (currently 1,000 units) and provide sufficient bandwidth and computing power to run these features. In exchange, they receive a share of block rewards and transaction fees, which incentivizes quality of service.

To prevent masternodes from centralizing the network too much, Dash uses a mining algorithm called “X11” that combines eleven different hash functions. The idea is to smooth out the difficulty and distribute the work between GPUs and ASICs, without sacrificing the latter’s advantages in terms of security and energy efficiency. A pragmatic choice, which aims to reconcile decentralization and performance.

As we can see, mining is a constantly evolving field, where different visions of what a crypto should be clash. Between PoW and PoS, ASIC and GPU, confidentiality and traceability, there is no perfect solution but a multitude of approaches that seek to find the right balance between security, accessibility and sustainability.