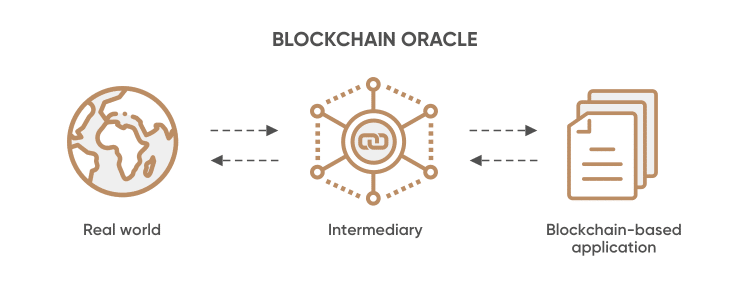

Oracles act as bridges, connecting smart contracts on the blockchainBlockchain A public and immutable ledger of cryptographic transactions, organized in blocks. with external data. They can retrieve, verify, and transmit information from sources such as databases, APIs, and other networks, making it accessible on-chain.

How Do They Work?

Oracles enable the creation of hybrid smart contracts, where on-chain code and off-chain infrastructure are combined to supportSupport A price level where buying pressure is expected to be strong enough to prevent further price declines. decentralized applications (dApps) that respond to real-world events and interact with traditional systems.

By providing Web3 access to external data sources (off-chain) and existing systems, oracles allow applications to interact with an environment outside the blockchain, facilitating real-world applications. This data can include assetAsset Any digital asset, including cryptocurrencies. prices, macroeconomic figures, sports results, and more.

Their role is crucial because in Decentralized Finance (DeFiDeFi DeFi services use smart contracts, decentralized protocols, and tokens to offer a range of financial services that can sometimes replace those offered by banks, such as lending/borrowing, asset management, insurance, or asset exchange.), which relies on off-chain information, it is essential to depend on a reliable, smooth, uncensorable, and non-manipulable oracleOracle A service that provides off-chain data to a blockchain, enabling smart contracts to interact with real-world information. mechanism.

Types of Oracles

- Data Oracles: Provide external data to smart contracts, such as cryptocurrencyCryptocurrency A digital currency based on cryptographic technology to verify and secure its transactions and control the supply. A blockchain is used to store transactions transparently and verifiably. prices or exchange rates.

- Calculation Oracles: Perform external calculations and return the results to smart contracts.

- Hardware Oracles: Connect smart contracts to physical devices, enabling interaction with the real world.

Chainlink, with its cryptocurrency LINK, is the oldest and most well-known oracle in the ecosystem. It represents over 75% of oracle projects and is present in major DeFi projects like AAVE.

Like many projects, it’s important to distinguish between the project and its tokenToken A digital asset issued on a blockchain, representing various utilities, rights, or value. and their respective uses. LINK is often criticized because its token is perceived as having limited utility, beyond potential marketMarket A place where assets are bought and sold. dumps by its team.

Other notable oracles include Band Protocol, Pyth Network, DIA, and more. To compare different protocol approaches and their tokens, this article may be helpful: Hacker Noon – Oracles Revenue and Tokenomics.

Decentralized Oracle Networks

Oracles must be reliable and secure to ensure the integrity of smart contracts. They need to be resistant to manipulation and false information, ensuring that smart contracts receive accurate and up-to-date data.

A centralized oracle, if it experiences spontaneous disconnection, could lead to a DeFi protocol losing access to information and potentially derailing the project entirely, given the automated nature of such systems.

Use Cases

Imagine a smart contractSmart Contract A self-executing contract with the terms directly written into code on a blockchain. for weather insurance. If the temperature exceeds a certain threshold, the contract automatically executes, and compensation is paid. Oracles play a crucial role here by providing accurate and real-time weather data to the smart contract, allowing smooth and automatic execution based on real-world weather conditions.

Other examples include: asset pricing for finance, randomness for gaming, IoT sensors for supply chains, identity verification for government purposes, etc.

In the DeFi universe, oracles serve, among other things, the following applications with examples of projects using Chainlink:

- Price Feed: Money markets (AAVE)

- Underlying Price: StablecoinStablecoin A cryptocurrency pegged to a stable asset, such as a fiat currency, to minimize volatility. peg, synthetic values (Synthetix)

- Price Determination: FuturesFutures A contract to buy or sell an asset at a predetermined price in the future. and Options contracts (Lyra)

- Proof on-chain Reserve: (RenBTC)

- Automated Asset Management: (Pickle Finance)

Innovations such as the CCIP (Cross Chain Interoperability Protocol) enable the transfer of information and/or tokens across chains (Open Source).

For further exploration of real-world cases, here is a list of solutions provided by Chainlink: Chainlink Blog – Smart Contract Use Cases.

Conclusion

Oracles are vital for the current functioning of DeFi and its connection to the real world, bringing with them a set of questions:

- Can oracles scale sufficiently without creating securitySecurity The measures and technologies used to protect blockchain networks and assets from theft, fraud, and attacks. (no latency during high volatilityVolatility The degree of variation in an asset's price over time.) or economic problems (costs related to big data processing and inherent gas fees)?

- Are the incentives adequate to operate oracles in an optimized and secure manner?

- Are oracles sufficiently decentralized to avoid central attacks, errors, and thus compromise the functioning of Decentralized Finance?

In this context, some believe that the future of DeFi should be developed without external dependencies, as seen in projects like Ajna, Ethereum Credit Guild, Metastreet’s Automated Tranche MakerMaker An entity that provides liquidity to a market by placing limit orders., and Blur/Paradigm’s Blend…