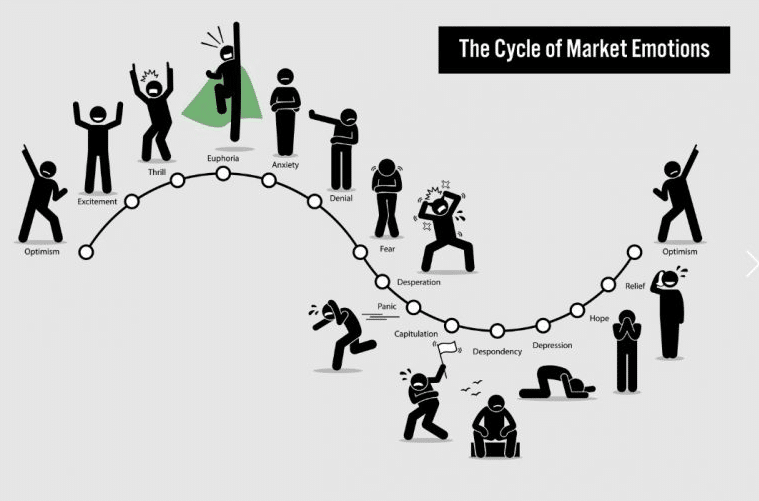

Trading is often seen as a purely technical activity, where chartChart A graph representing price changes over time. analysis and complex strategies determine profitability. However, behind this idea lies an equally essential factor: psychology. Mastering your emotions and understanding cognitive biases is crucial to surviving and thriving in an ecosystem as volatile as crypto.

In trading, psychology is the backbone. What sets a good trader apart from a great one is their ability to manage their emotions, understand them, analyze them, and then draw conclusions from them. That being said, even the most experienced traders aren’t immune to emotional biases—this is long-term work.

What are the main emotions to avoid?

Crypto, in general, is a stressful environment, and several emotions can interfere with rational decision-making:

- Fear

Fear is everywhere, whether it’s fear of losing capital (Fear of Loss) or fear of missing out on an opportunity (FOMOFOMO The fear of missing an opportunity, often leading to impulsive buying.). This feeling is extremely damaging in the short term and can cause you to close positions too early or, conversely, buy too late out of fear of missing the next bullishBullish A positive outlook on the market or a project, believing that prices are likely to rise. move.

- Greed

Greed pushes traders to ignore their plans in an attempt to maximize gains. This often leads to not taking profits in time, hoping that the move will continue indefinitely. A great indicator of your greed level is simply noticing when you take a screenshot to post it on Twitter (highly backtested).

- Hope

Hope is the enemy of rational money. Instead of cutting a losing position, a trader might hope the marketMarket A place where assets are bought and sold. will turn around, letting the loss grow. This is one of the most common mistakes, often based on an inability to accept reality. Trading should be driven by data, and only data. At the end of the day, the only variable that matters is making money while taking the least risk possible. Everything else is just noise.

- Regret / Revenge Trading

Regret can arise after a bad decision, leading to a loss of confidence. The most common pattern is regretting not selling earlier, leading to overcompensation in the next trades. The problem is that the martingale strategy is mathematically a losing one. The conditional expectation of the next value in a series is equal to the current value, regardless of previous values.

What are the 3 cognitive biases tied to these emotions?

In most cases, these emotions stem from a biased interpretation of reality: cognitive biases are present in our daily lives, we hear them, we sometimes say them, and they often go unnoticed. The problem is when they influence how we interpret information and make decisions.

The most common ones include:

- Confirmation Bias

This bias leads people to seek out only information that confirms their pre-existing beliefs while ignoring contrary facts. It’s very common in tokenToken A digital asset issued on a blockchain, representing various utilities, rights, or value. communities, for example. If you only check the subreddit of EGLD holders, the world will seem crazy for not buying it (and yet…).

- Loss Aversion

Traders hate losing more than they love winning. This bias pushes them to make irrational decisions to avoid an immediate loss, such as holding onto a losing position for too long, hoping it will return to the green.

- Disposition Effect

This bias causes traders to sell their winning positions too early to lock in gains, while holding onto their losing positions in the hope they’ll recover. This goes against the basic principle of “letting your winners run and cutting your losers.”

How can you master your own psychology?

Self-control is a skill that can be developed over time, but here are a few ways to better manage emotions and cognitive biases when trading crypto:

- Have a Trading Plan

Creating a clear trading plan, with entry and exit price targets, as well as predefined stop-loss levels, helps reduce the influence of emotions. This plan must be followed no matter what, to avoid impulsive decisions driven by market fluctuations.

- Control Position Size

Never risk a significant portion of your capital on a single trade. Strict risk management reduces anxiety related to potential losses and helps maintain calm.

- Accept Uncertainty

Markets are inherently unpredictable, and it’s important to accept that some positions will result in losses. Accepting failure as part of the trading process helps you put losses into perspective and avoid frustration.

- Take Breaks

Knowing when to step away is essential. When emotions are running high, it can be beneficial to take a break. Stepping away from the screens can bring clarity, preventing impulsive decisions. In short, if you feel like things are slipping out of control, touch some grass. The market will still be there when you come back, I promise.

- Adopt a Long-Term Approach

The best traders are those who manage to adopt a long-term mindset. This means they don’t get swayed by short-term fluctuations and strive to stay calm through market cycles. They know that patience and discipline ultimately pay off.